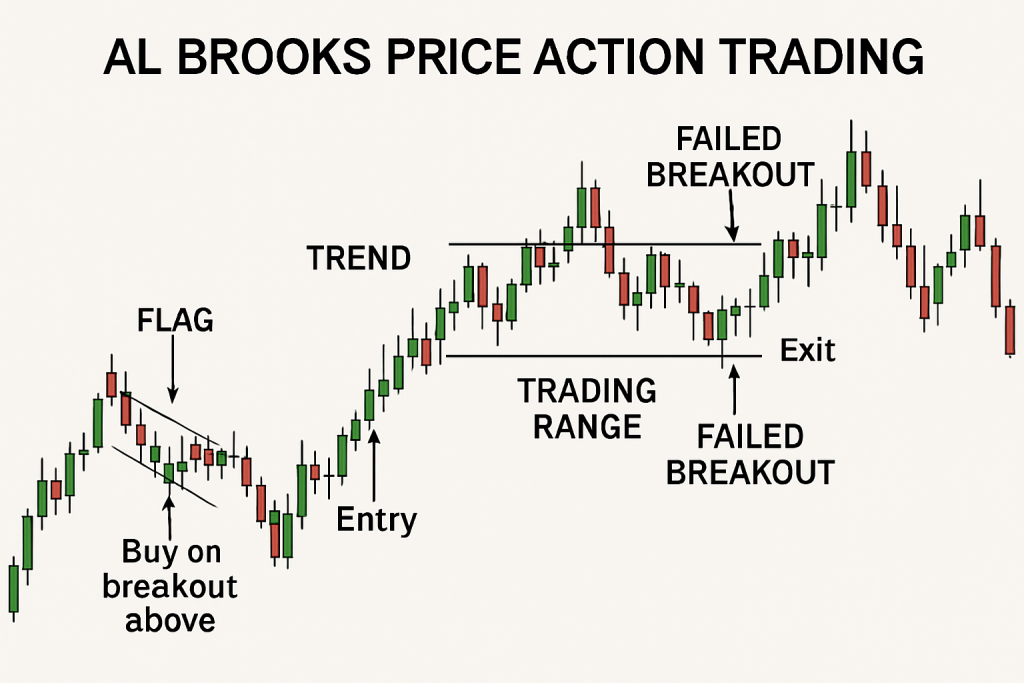

Al Brooks part2

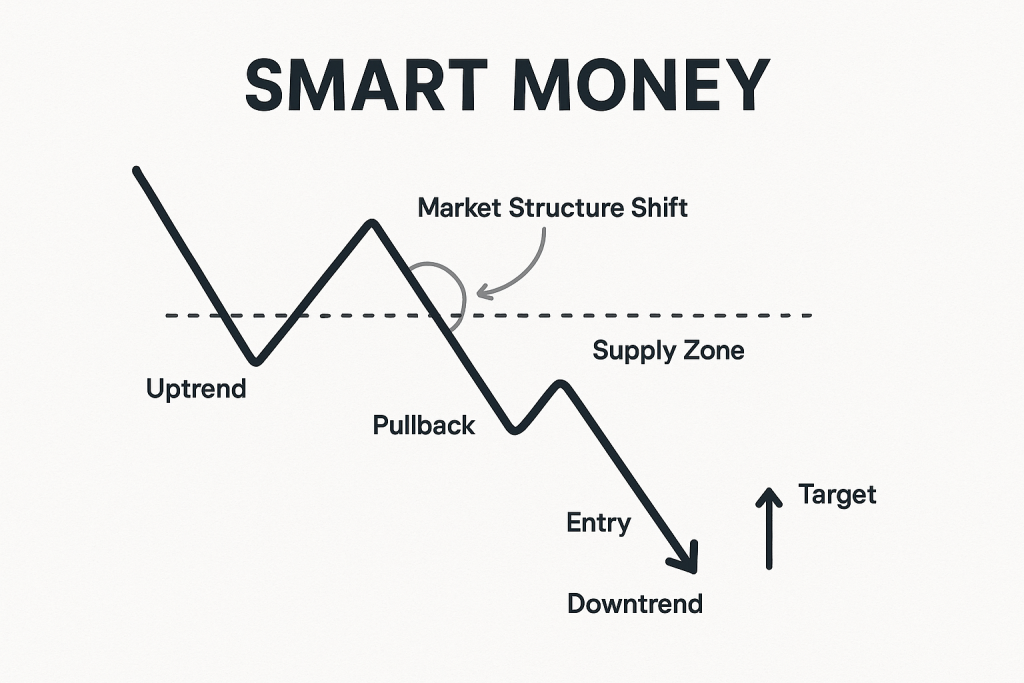

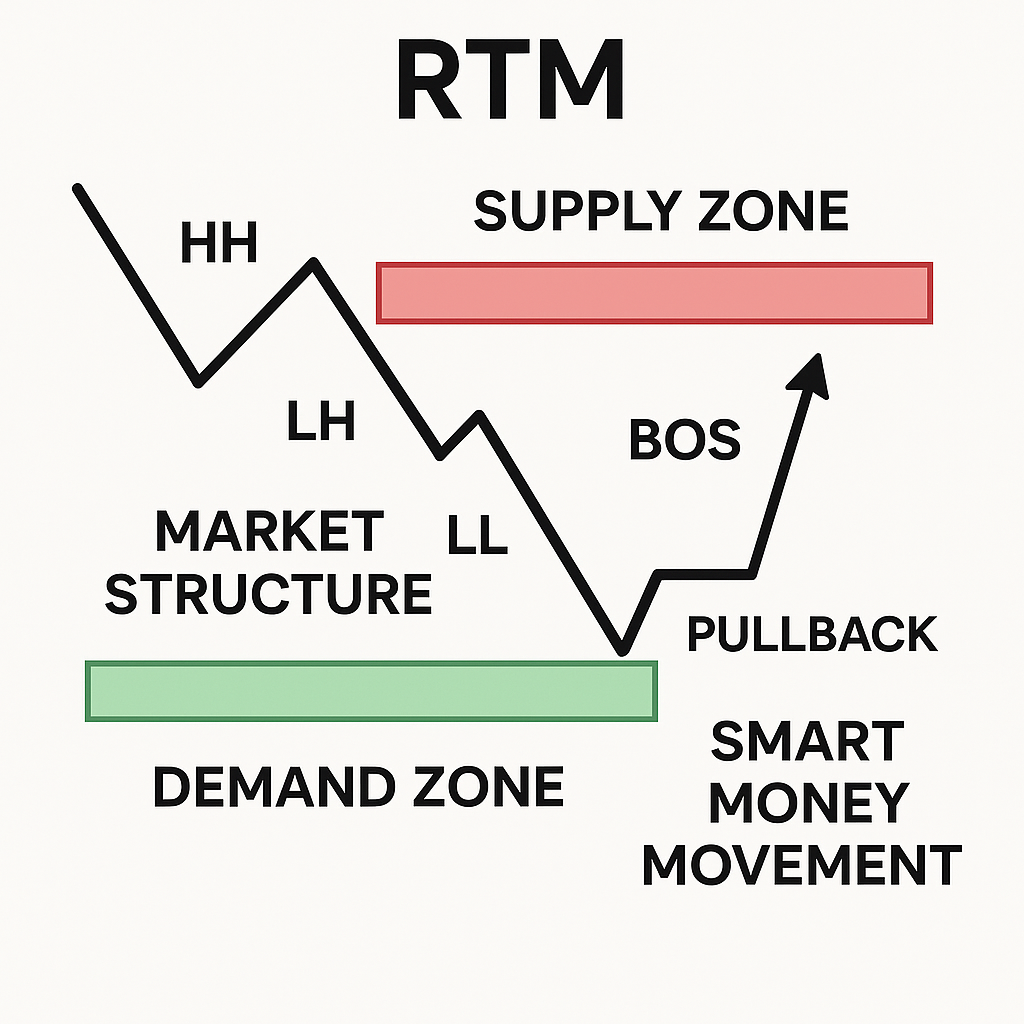

📘 Al Brooks Price Action – Part 2/2 Advanced Price Action Analysis, Setups, and Multi-Timeframe Context — 🔄 Trend Reversals Understanding how trends reverse is key to catching profitable moves before they become obvious. According to Al Brooks, trend reversals usually begin with one of the following: Double tops/bottoms […]