📘 Al Brooks Price Action – Part 2/2

Advanced Price Action Analysis, Setups, and Multi-Timeframe Context

—

🔄 Trend Reversals

Understanding how trends reverse is key to catching profitable moves before they become obvious. According to Al Brooks, trend reversals usually begin with one of the following:

Double tops/bottoms

Wedges (3-push patterns)

Trendline breaks followed by lower highs or higher lows

Climactic exhaustion moves

🔍 Example:

A market in a strong uptrend creates a double top near resistance. The second high has a weaker bull candle and is followed by a strong bear reversal bar. A trendline break confirms the setup. This is a classic Al Brooks reversal signal.

—

🚀 Strong Trends

Strong trends have minimal pullbacks and continuous pressure in one direction. Characteristics include:

Repeated large trend bars in one direction

Gaps between bars or breakouts with follow-through

Few or no meaningful pullbacks

🛠 Strategy:

In strong trends, don’t fade the move. Wait for minor pullbacks to enter in the trend’s direction using smaller timeframes to time your entries.

—

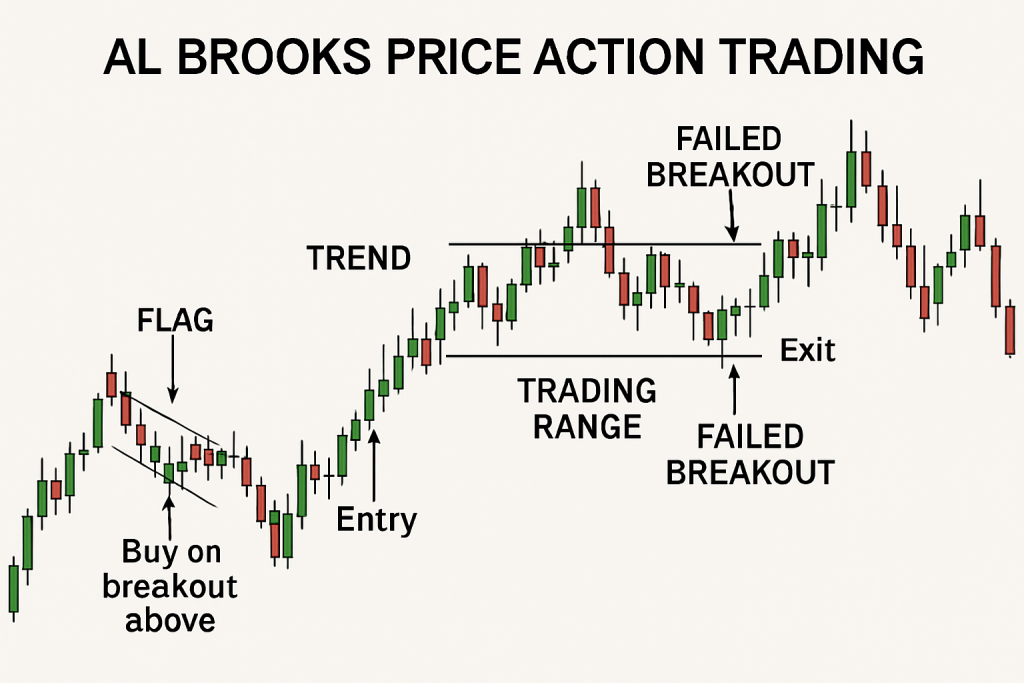

⚑ Flags (Continuation Patterns)

Flags are consolidation patterns within a trend, often forming:

Bull flags in uptrends

Bear flags in downtrends

These usually look like tight ranges or channel pullbacks. Once they break in the trend’s direction, continuation is expected.

🔍 Example:

After a strong bull trend, price forms a small downward channel (a bull flag). A breakout above the flag’s upper trendline with a strong bull bar is an entry signal for continuation.

—

🔼 Ascending and Descending Wedges (Converging Patterns)

These are reversal or continuation patterns formed by converging trendlines:

Ascending wedge: Often reverses uptrends

Descending wedge: Often reverses downtrends

Brooks emphasizes watching for three pushes to confirm a wedge.

—

🔺 Triangle and Rectangle Patterns

🔼 Triangle:

Formed by converging trendlines (symmetrical or asymmetrical).

Signal consolidation, often before a breakout.

▭ Rectangle:

A horizontal trading range with equal highs and lows.

Could break in either direction; watch for breakout bars and follow-through.

—

📈 Channels

Channels are defined by a trendline and a parallel line on the opposite side of price action. There are two types:

Tight channels: Clean trends with minimal pullbacks.

Broad channels: Trends with overlapping bars and frequent deep pullbacks.

—

🪄 Channel and Trendline Duel

Sometimes, two trendlines form a “duel”—one acting as a tighter inner channel, the other a broader outer trendline. Brooks shows that when the inner line breaks, price often heads toward the outer trendline.

—

📊 Analyzing Price Legs

A leg is a directional move. Al Brooks suggests counting legs:

Most pullbacks have 2 legs.

Complex corrections have 3 or more.

Example:

An uptrend pulls back with one bear leg, a pause, and then another bear leg. The second leg often marks the end of the correction — a signal to look for longs.

—

🌀 Channel Conditions: Strong, Weak, and Transitioning

Brooks classifies channels into three states:

1. Strong trends: Minimal pullbacks

2. Weak trends: Pullbacks overlap, many doji candles

3. Transitioning: Signs of reversal, including failed breakouts

Recognizing these transitions is crucial to avoid chasing trends late or fading too early.

—

📏 Trading Ranges (Sideways Markets)

Trading ranges dominate markets more than trends. They consist of horizontal price movement, with clear support and resistance.

Tips:

Fade moves near the edges of the range.

Avoid breakout entries unless there is strong momentum and follow-through.

—

🔁 FTR – Failure to Return

An FTR is a zone where price fails to return after a breakout or a strong rejection. It creates high-probability zones where price is likely to react again.

Example:

Price rejects a resistance level and collapses. It returns later, touches the same level but shows rejection again. That zone is an FTR and becomes a supply zone.

—

📉 Big Up – M Pattern – Big Down

Brooks explains how a bullish surge (Big Up) can be followed by an M pattern and then a strong bearish move (Big Down). The M formation is often subtle but shows up as:

A higher high with a bearish reversal bar

A lower high confirming the second top

Breakdown below the middle of the M

This signals a reversal of sentiment and momentum.

—

⏪ Reversal Trading Ranges

Some ranges form at the end of a trend, not as continuation. These act as reversal bases where price accumulates orders before flipping direction.

—

🌐 Multi-Timeframe Supply & Demand Zones

Brooks emphasizes aligning zones across multiple timeframes. For example:

If H1 and H4 both show resistance at the same level, it becomes stronger.

A setup on M15 that aligns with a higher timeframe zone has higher probability.

—

🔁 Pullbacks

Pullbacks are temporary movements against the prevailing trend. Brooks stresses the importance of pullback structure:

2-leg pullbacks are common.

Entry is usually taken on the end of the second leg, especially if it ends with a strong signal bar.

—

🟢 EMA Pullbacks

When price pulls back to the 20-EMA, it often finds support/resistance there. Brooks highlights:

EMA = dynamic S/R in trends.

Look for reversal signal bars at the EMA.

More reliable in tight channels.

—

🧲 Magnet Areas

A magnet is a price level that repeatedly pulls price toward it. It could be:

A previous high/low

Midpoint of a range

A major moving average

—

📤 Breakout Spike

A spike is a sudden surge in price with momentum. After a spike, price usually forms a channel.

Brooks calls this the spike and channel trend:

1. Spike = breakout

2. Channel = grind in the same direction

—

🧬 Micro Channels

Very tight trends with small candles and no meaningful pullbacks. These are hard to trade but very bullish or bearish depending on direction.

—

🔁 MTR – Major Trend Reversal

Brooks’ Major Trend Reversal setup includes:

A strong trend

Loss of momentum

Double top/bottom or wedge

A strong signal bar in the new direction

This is one of the most powerful reversal patterns in Al Brooks’ method.

—

🏆 Al Brooks’ Top 10 Setups

1. Second entries

2. Wedge reversals

3. Failed breakouts of ranges

4. Pullbacks to EMA with signal bar

5. Micro double tops/bottoms

6. Trendline breaks with retests

7. Strong signal bars at S/R

8. Failed second entries

9. Reversals off prior highs/lows

10. Spike and channel ends

These setups are core to Al Brooks’ strategy and represent high-probability opportunities when traded with proper context.

—

🧠 Final Thoughts

Al Brooks’ Price Action methodology is dense but rewarding. It focuses on reading price like a story, candle by candle. Mastery takes time, but applying these principles with discipline offers clarity in even the most chaotic markets.