📘 Supply and Demand Method – Part 3

Expert Patterns: The Ultimate Guide to Advanced Supply and Demand Trading

—

🔹 16. FTR vs PAZ (Price Action Zone)

FTR (Failure to Return):

Zone is skipped → price avoids it → shows urgency → zone remains fresh.

PAZ (Price Action Zone):

Zone respected multiple times → more tested → less powerful → usually continuation.

Feature FTR PAZ

Behavior Skipped Multiple retests

Freshness Fresh (untouched) Used (weaker over time)

Signal Strong impulse Continuation or break

Entry First touch Only with extra confirmation

Example:

FTR: USD/JPY skips a major demand at 150.00 → flies to 152.50

PAZ: EUR/USD retests 1.0800 zone three times before break.

—

🔹 17. Flag vs Limit Entry

Flag Entry:

Wait for price action confirmation → engulf, pin bar, or retest

✅ Safer, but you risk missing the move.

Limit Entry:

Set a pending order right at the zone

⚠️ Higher R:R, but risk of false entry increases.

Entry Type Risk Reward Need Confirmation?

Flag Low Medium Yes

Limit High High No (predefined)

Best Practice:

Use Flag in unconfirmed zones.

Use Limit in high-quality, fresh zones near curve extreme.

—

🔹 18. CP and MPL

CP – Compression Pattern

Price grinds toward a zone in weak candles → likely to break through.

Shows lack of power

Often occurs in trends

Good for breakout trades

MPL – Maximum Pain Level

Point in a zone where most orders have been absorbed

Often midpoint or edge of base

Best place to put entry

Example:

Price creates 4 weak candles approaching supply at 1.1000 (CP), then breaks above. But returns to 1.0995 (MPL) before dropping.

—

🔹 19. 3-Drive Pattern

The 3-Drive is a reversal pattern using price and momentum:

Three pushes in one direction

Often forms in curves’ extremes

Each push has less momentum

Rules:

1. Measure each leg with Fibonacci

2. 3rd drive = ideal zone to reverse

3. Look for confirmation (engulf, FTR)

Example:

AUD/USD forms 3 consecutive higher highs into a supply zone → RSI divergence + engulf = powerful short.

—

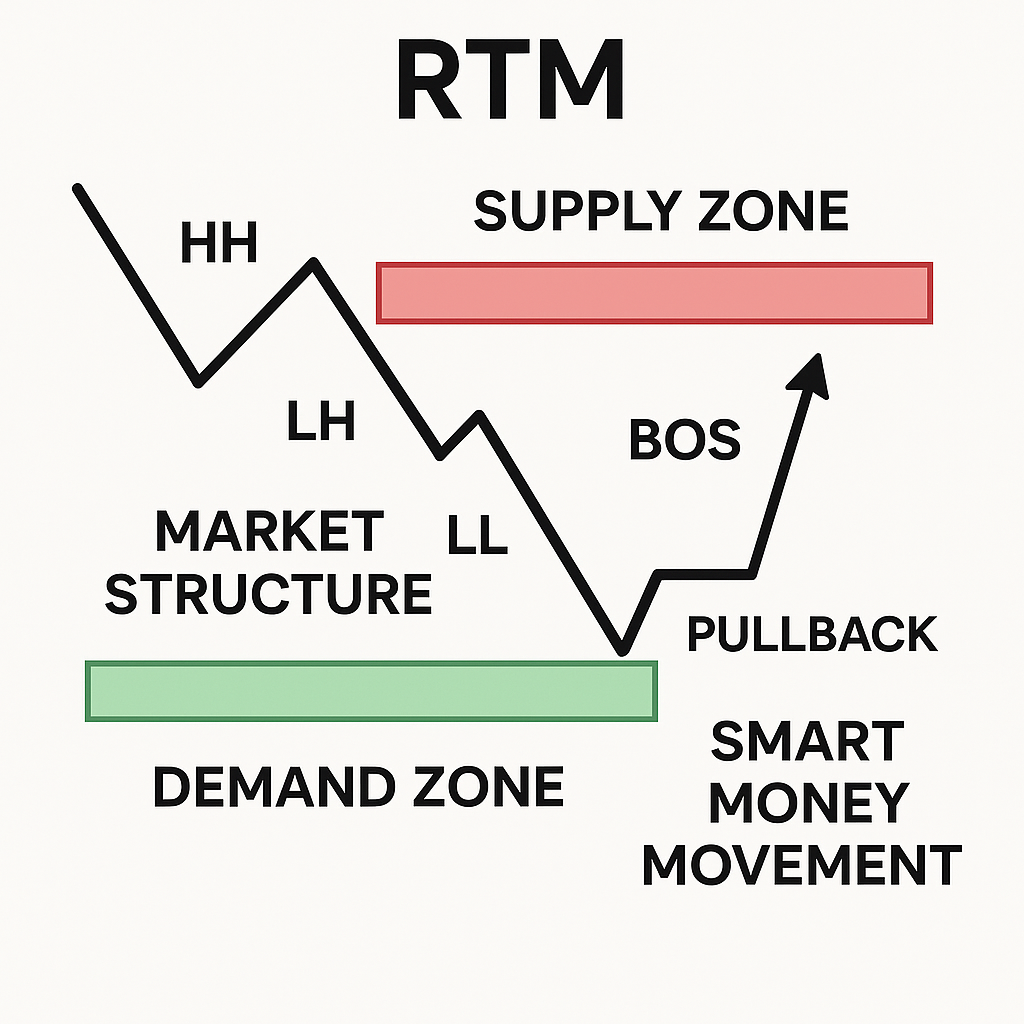

🔹 20. QM – Quasimodo Pattern

Quasimodo (QM) is one of the most reliable reversal patterns in S&D.

Structure:

HH or LL is formed

Then sharp reversal

Leaves an imbalance (ideal entry zone)

Bullish QM Bearish QM

LL → LH → HL → HH HH → HL → LH → LL

How to Trade:

1. Mark the base before the extreme high/low

2. Enter on first return to that level

3. Look for engulf + curve alignment

—

🔹 21. CAPS – Compression And Strong Push

CAPS = Compression + Aggressive Push + Strong Reaction

Why it’s powerful:

Price compresses slowly → then blasts out

Reaction shows imbalance

Return to origin = high-probability entry

Strategy:

1. Identify compression zone

2. Look for sharp breakout

3. Mark base before breakout

4. Enter on first touch

Example:

NZD/USD consolidates between 0.6050–0.6060

Breaks aggressively to 0.6150

Pullback to 0.6060 = buy

—

🔹 22. Important Repeating Questions (For Every Trade)

Before every trade, ask:

1. Is this a fresh zone?

2. Is it near curve extremes?

3. Was there a strong departure?

4. Is the base clean?

5. Are we in HTF context?

6. Is there a confirmation signal?

7. Is the risk-reward ratio > 2:1?

The more YES answers, the better.

—

✅ Summary of Part 3

Pattern Use Case

FTR Unfilled zone, reversal

PAZ Continuation, used zone

Flag / Limit Flag = confirmation; Limit = risk/reward

CP / MPL CP = break zone; MPL = perfect entry point

3-Drive Momentum-based reversal

Quasimodo (QM) Structural reversal

CAPS Reaction to compression

—

❓ FAQs – Part 3

Q: Which pattern works best in volatile markets?

A: CAPS and FTR are highly reliable in volatility.

Q: What’s better: QM or 3-Drive?

A: QM is more reliable for short-term entries. 3-Drive is better for swing trades.

Q: Can I use these in crypto/forex/indices?

A: Yes! These concepts are universal.