📘 The Complete Guide to Wyckoff Theory: Decode the Market Like a Pro

Understand how smart money moves, identify market phases, and apply professional strategies using the Wyckoff Method.

Introduction

Financial markets may seem chaotic, but behind every price movement lies a hidden pattern—driven by supply, demand, and the behavior of big players. The Wyckoff Method helps us uncover that pattern and trade like the professionals.

In this comprehensive guide, you’ll learn everything you need to know about Wyckoff Theory—from foundational principles to practical chart analysis and real-world trading setups.

Section 1: What Is the Wyckoff Method?

The Wyckoff Method was developed in the early 1900s by Richard D. Wyckoff, a pioneer in technical analysis. He studied how large institutional investors—known today as “smart money”—operate. His goal was to help retail traders spot the footprints of these big players and profit by following them.

Section 2: The Three Laws of Wyckoff

🔹 1. The Law of Supply and Demand

Price moves based on the relationship between supply and demand:

- Demand > Supply → Price rises

- Supply > Demand → Price falls

🔹 2. The Law of Cause and Effect

Every large price move (effect) stems from a prior accumulation/distribution phase (cause).

🔹 3. The Law of Effort vs. Result

Compares volume (effort) to price action (result):

- High volume + small move = weakness

- Low volume + strong move = hidden strength

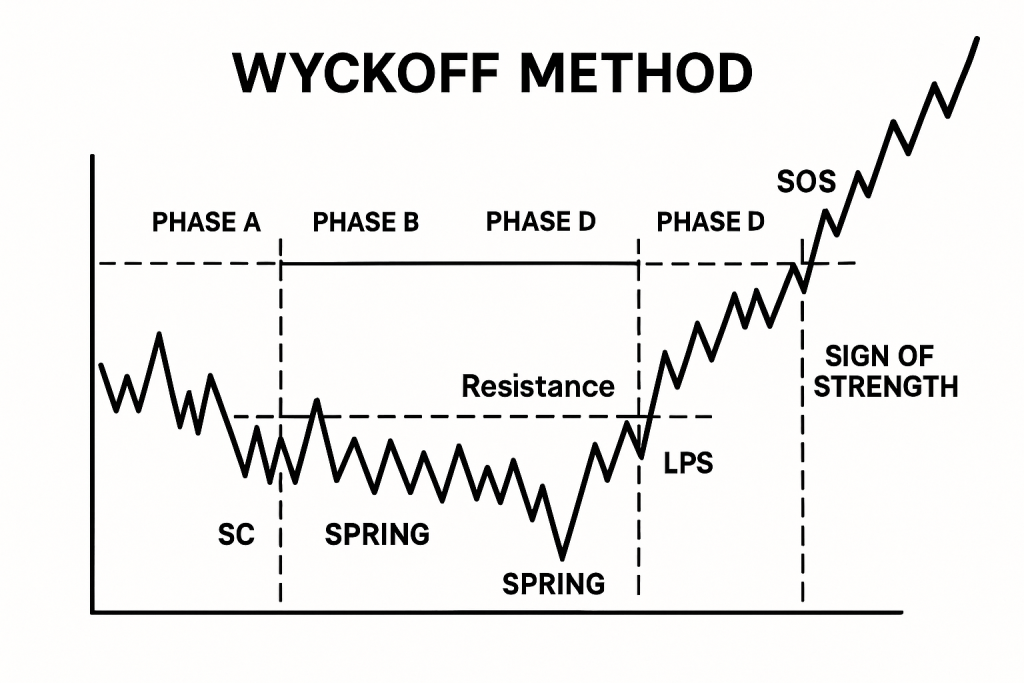

Section 3: Wyckoff Market Structure

Markets move in two key phases:

- Accumulation: Smart money buys quietly at low prices

- Distribution: Smart money sells at high prices

Section 4: Accumulation & Distribution Phases

🟢 Accumulation

| Label | Description |

|---|---|

| SC | Selling Climax – Sharp drop with high volume |

| AR | Automatic Rally – Fast recovery |

| ST | Secondary Test – Retest of SC with less volume |

| LPS | Last Point of Support – Higher lows with declining volume |

| SOS | Sign of Strength – Breakout with volume |

🔴 Distribution

| Label | Description |

|---|---|

| BC | Buying Climax – Sharp rise with volume |

| AR | Automatic Reaction – First pullback |

| ST | Secondary Test – Test of highs with weak volume |

| UT | Upthrust – False breakout above resistance |

| SOW | Sign of Weakness – Breakdown on volume |

| LPSY | Last Point of Supply – Weak rally before collapse |

Section 5: The 5-Step Wyckoff Strategy

- Identify Market Phase

- Determine the Cause

- Estimate the Effect

- Select Strong Asset

- Wait for Confirmation

Section 6: Entry/Short Strategy Examples

✅ Entry Strategy

- Enter on SOS above AR

- Stop-loss under LPS

- Target 1: $21,500 | Target 2: $25,000

❌ Short Strategy

- Enter below SOW

- Stop above UT

- Target 1: $3,500 | Target 2: $2,800

Section 7: Real Chart Analysis (Step-by-Step)

- Zoom Out

- Check Volume

- Compare Reactions

- Label Phases

- Wait for Confirmations

Section 8: Common Traps

- Mislabeling Phases

- Ignoring Volume

- No Confirmation = Risky Trades

Section 9: Practice Exercises

- Exercise 1: Identify SC or UT in any chart

- Exercise 2: Find both an accumulation & distribution chart

Section 10: Wyckoff + Price Action

| Candlestick | Wyckoff Context |

|---|---|

| Hammer | LPS |

| Bearish Engulfing | UT or SOW |

| Doji (high volume) | Uncertainty |

| Bullish Marubozu | SOS |

Final Thoughts

The Wyckoff Method offers a professional edge by aligning with the actions of smart money. With practice, you’ll learn to trade with clarity and confidence using this powerful approach.